-

1 expert ex4

Explanation:

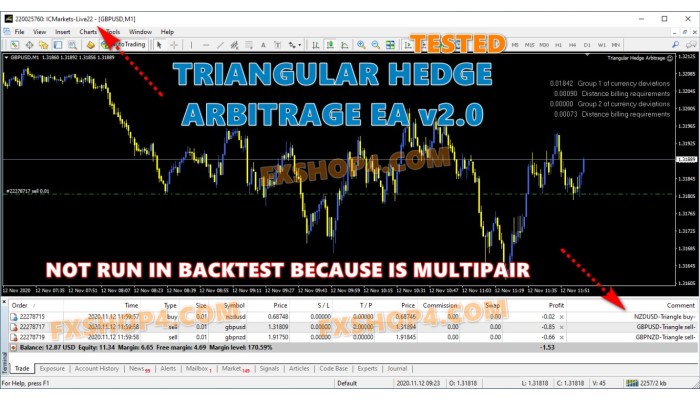

Strategy principle: It is a mutual hedging between two straight and a cross , and it can also be a hedged currency between the crosses.

The use of three foreign exchange pairs, the temporary deviation of reasonable cross prices to achieve hedging.

Strategic risk: Due to the high liquidity of the foreign exchange market, the market is effective most of the time, but sometimes there will be short-term imbalances in the market, causing the market price of the cross currency pair to deviate from the synthetic price.

When this deviation is enough to offset us We can use the triangular arbitrage method to achieve risk-free arbitrage.

Three-currency hedging arbitrage-EA: refers to a trading strategy that uses the spread of multiple currencies in different markets to carry out arbitrage actions.

Because one transaction is generally performed by three currencies for three operations, forming a triangular relationship, it is called three Currency hedge arbitrage.

Add more test simulation strategies that suit you! ! I don’t know where to call to discuss the idea of hedging transactions

TRIANGULAR HEDGE ARBITRAGE v2.0

- Product Code: EA394

- Availability: In Stock

Tags:

EA,

Expert Advisor,

Forex Robot,

MT4,

MT5,

XAUUSD,

Gold EA,

Gold Trading,

Prop Firm EA,

Auto Trading,

Algorithmic Trading,

H1 EA,

Easy to Use EA,

Fully Automated,

Scalping,

Swing Trading,

Smart EA,

AI Powered,

Forex Strategy,

Trading Bot,

Low Deposit EA,

No Martingale,

No Grid,

Compatible with Prop Firms